Investors from abroad interested in company formation in Canada can establish several business forms like corporations, partnerships, co-operatives or sole proprietorships. For each kind of entity, varied conditions and requirements are imposed, in accordance with the Commercial and Civil Laws in Canada. The requirements for company incorporation in Canada can be explained by our team of company formation specialists. They can also help you when drafting the documents with the authorities in charge. You can contact us for details about the procedures for starting a business in Canada.

| Quick Facts | |

|---|---|

| Types of companies |

– sole proprietorship, – partnership (types: general, limited, limited liability), – corporations (types: Canadian-controlled private, other private, public, an entity controlled by a public corporation, other type) |

|

Minimum share capital for LTD Company |

None for private corporation (equivalent of an LTD) |

|

Minimum number of shareholders for Limited Company |

1 |

| Time frame for the incorporation (approx.) |

1 day |

| Corporate tax rate |

Standard corporate tax rate 38% (with some reductions) |

| Dividend tax rate |

The standard dividend tax is 10%, but it can reach 40% in certain situations |

| VAT rate |

The stardard VAT in Canada (known as the GST – Goods and Services Tax) is 5% |

| Number of double taxation treaties (approx.) | 94 |

| Do you supply a registered address? | Yes |

| Local director required | In most of the Canadian provinces, the local director requirement is applicable, except Ontario |

| Annual meeting required | Yes |

| Redomiciliation permitted | Yes |

| Electronic signature | Yes |

| Is accounting/annual return required? | Accounting and annual tax returns are required for local businesses. |

| Foreign-ownership allowed | Yes |

| Any tax exemptions available? |

– foreign tax credit relief, – deductions from income expenses, – tax exemptions on dividends, – tax exemptions on interest, – exemption on the withholding tax on royalties |

| Tax incentives |

– the refundable investment tax credit for expenditures in scientific research, – federal production tax credit, – provicial incentives, – incentives for certain industries |

| Legal entities for non-residents in Canada |

– partnership, – corporation, – cooperative, – branch |

|

Rule of law for non-resident businesses in Canada |

– Investment Canada Act, – Business Corporation Act |

|

Investment programs for foreign investors |

– Strategic Innovation Fund, – Scientific Research & Experimental Development, – Canada’s Pan-Canadian Artificial Intelligence Strategy |

Types of companies in Canada

There are a few types of entities for starting a business in Canada:

- sole proprietorships – require a single member who conducts the business by himself/herself;

- partnerships which can be general or limited and needs at least two founding members;

- corporations which must have at least one shareholder and a director;

- co-operatives which can be established as for-profit or non-profit reasons and can have a large number of shareholders.

Foreign companies can register branches, representative offices and subsidiaries in this country and our specialists in company incorporation in Canada can offer help with the local procedures.

Partnerships in Canada

Two or more individuals can establish a partnership in Canada, which is considered a non-incorporated business, where the financial resources are combined and invested in starting a business in Canada. In accordance, the profits of the firm are shared as established in an agreed contract signed when the partnership was settled. In general partnerships in Canada, partners are subject to legally responsible debt payments, compared to the limited partnerships where an individual can underwrite to a business without being part of its actions. The main benefits of setting up a partnership as part of company incorporation in Canada are the low costs, tax advantages and the equal share of the profits at a certain point.

Corporations in Canada

A corporation is also a suitable option for those who want to open a business in Canda, considering the legal aspects and the requirements in this matter. For instance, the stockholder of such entity is not responsible for the company’s debts or any kind of obligations. Also, starting a company in Canada in the form of a corporation will be subject to a particular tax system and the business owner can have several advantages. One should know that the ownership of a corporation in Canada is transferable, and the formation of the company is made at a federal or territorial level. For any kind of company incorporation in Canada, we remind that our company formation agents in Canada are at your disposal with comprehensive information about the registration process and the steps to consider when drafting the documents with the authorities in charge of business registration.

Co-operatives in Canada

The profit distribution, the limited liability, and full control of the activities are among the attributes of a co-operative in Canada. The association of members of a co-operative oversees its activities and such a business entity can be set up as a for-profit or not-for-profit body. Even if it’s not the main selection when establishing a company, investors can choose this kind of entity if there is a need for gathering resources and providing access to mutual needs in accordance with the initial project. Please consider that at any time, an individual can change the business structure and adopt a new one if the plans have been reformed or the improvements demand such transformation. For details about this and the procedures for company incorporation in Canada, you may contact our specialists.

Opening a subsidiary company in Canada

Foreign companies are drawn by the Canadian developed industries, such as manufacturing, energy, and pharmaceutics which is why they are interested in establishing their presence on the local market. A subsidiary company can be a good idea for an international company interested in company incorporation in Canada. If you need assistance for setting up a subsidiary in another jurisdiction, for example in Singapore, we recommend our partners – OpenCompanySingapore.com, who are experts in company incorporation matters.

The subsidiary company must follow the same laws as local companies considering it will be registered as a corporation in Canada. The parent company must prepare the same set of documents as when registering a local business. Moreover, the Canadian subsidiary can be registered at a federal or regional level.

The following documents must be prepared for starting a business in Canada in the form of a subsidiary:

- the Canadian company’s Articles of Association and its bylaws must be drafted;

- the parent company’s Articles of Association and Certificate of Incorporation are also necessary;

- information about the subsidiary’s directors and managers (these requirements will differ from province to province);

- the lease contract indicating the legal address of the Canadian subsidiary.

It should be noted that each province has its own regulations related to the creation of subsidiary companies. Another interesting fact about Canada is that there are several types of subsidiaries which can be established here.

The Canadian branch office

Foreign companies seeking to control their Canadian entity can set up branch offices. This business form will follow the same registration requirements as the subsidiary and can also be established at a federal or provincial level. Foreign companies registering branches in Canada use these entities for specific projects which usually have a limited period.

With respect to the documents needed to open a branch office in Canada, these are the same as for a subsidiary company, however, the parent company must also appoint a secretary.

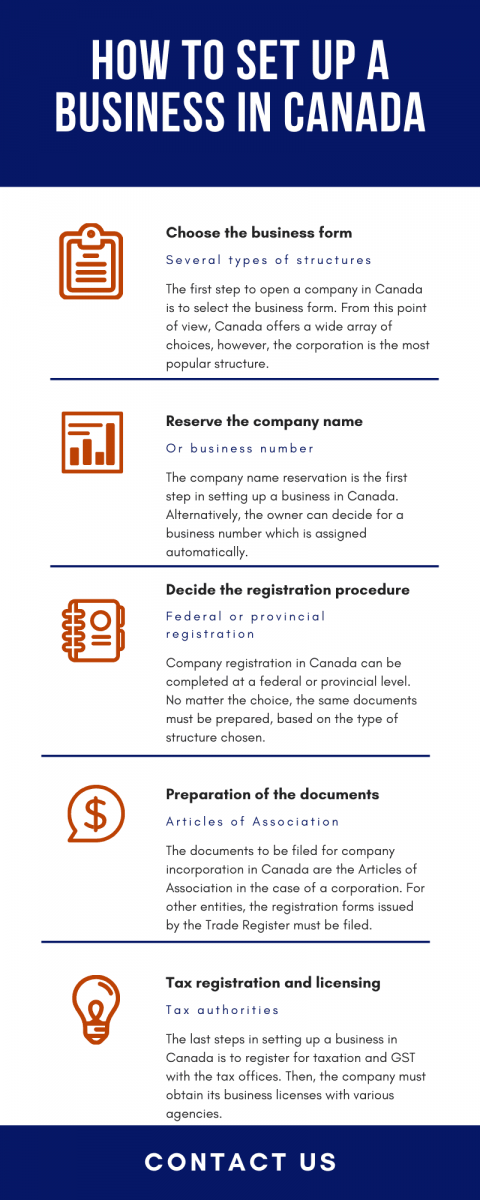

We have also created a scheme showing the procedure of opening a company in Canada:

Documents for company incorporation in Canada

Companies can be registered if the following documents are provided to the local institutions during the process of starting a business in Canada:

- articles of association through the federal or provincial incorporation entities in Canada;

- the business number which is issued by the Canada Revenue Agency for tax purposes;

- detailed information about the new company’s shareholders (name, address, nationality);

- information about the business address of the company to be registered;

- the company’s bank account where the share capital will be deposited.

Once the company incorporation process in Canada has successfully ended, the business owner or his/her representative must apply for special licenses and permits, in order to start the activities. Besides the legal support for your future company, suitable guidance when opening a business in Canada will be offered by our Canadian specialists in company incorporation.

We also invite you to watch our video on starting a business in Canada:

Company registration at federal and provincial levels in Canada

Foreign investors who want to set up companies in Canada can register them at the federal or provincial level. The main difference between the two types of registration procedures reside in the possibility of offering services and selling goods on the Canadian territory. Companies registered at a federal level can operate throughout the whole country, while companies incorporated at a regional level will be limited to operating in the province where the business is registered.

Our Canadian company formation representatives offer registration services at both federal and regional levels.

What are the main options for setting up a Canadian business as a non-resident?

The local Company Act is one of the most complete legal frameworks when it comes to starting a business in Canada. It provides for the conditions for both residents and non-residents to open companies in Canada.

A non-resident interested in having his/her own business in Canada can register a company under the following situations:

- If he/she owns a business abroad, he/she can move the existing company to Canada or set up a branch or subsidiary of it here;

- He/ she can register a company in any Canadian province or at a federal level and run it from his/her home country;

- He/she may incorporate a company in Canada by relocating here as a sole entrepreneur or self-employed individual;

- One can apply for a program enabled by the Canadian government, such as the Investor Venture Capital Scheme;

- The foreigner can choose the Canadian Entrepreneur Startup Visa which was created for investors from abroad.

No matter the choice, foreign investors seeking to open companies in Canada as non-residents can request our company registration services.

Setting up a business in Canada as a non-resident and managing it from abroad

One of the easiest ways of starting a business in Canada is by buying an existing company or creating a branch or subsidiary of it here and manage it from abroad. No matter the chosen business form, the non-resident investor must appoint a local agent to complete the company incorporation procedure in Canada.

The company can be set up in one province or territory in Canada or it can be registered at a federal level. The company can also operate in several provinces; however, it must be registered separately in each province or territory.

With a solid background in company registration in Canada, our local consultants can help those interested in setting up companies here as non-residents make a good decision.

Starting a business in Canada by moving here

Another option for non-residents who want to open companies in Canada is by moving here. They can do that by applying for a residence permit or by coming here based on a self-employment visa.

Most non-residents decide for these options when setting up companies in Canada; however, the requirements are very different when applying for a regular residence permit compared to obtaining a self-employment visa.

For example, when applying for a self-employment visa, a relevant condition is to have sufficient knowledge or expertise in the field the non-resident will operate.

How to open a company in Canada under one of the investment schemes available

It is possible for foreign investors to obtain an entrepreneur startup visa and set up a company in Canada under very advantageous conditions. It is also possible to enroll for the Investor Venture Capital Scheme, however, this will imply a significant investment in terms of capital.

Our company formation agents in Canada can offer detailed information on these programs available.

Programs for foreign investors

If you want to expand your business in Canada or you want to arrive here to set up your own company and become a resident, there are many programs available in this sense.

One of them is the Owner Operator program in Canada, which can grant to eligible candidates the right to permanent residency. Foreigners can open a business in any region of Canada as there aren’t any restrictions in this sense.

Persons who want to relocate here for work purposes can register in the Intra Company Transfer in Canada, which is also a pathway to permanent residency. The program is also available for foreign businessmen who want to expand their businesses in Canada. For both categories, there is a requirement of minimum one year of business activity/full-time employment, besides many other conditions.

Taxation of companies in Canada

In Canada, company taxes are applied at the federal and local levels. At a federal level, the maximum corporate tax rate is 38%, however, the authorities grant several tax deductions and thus the corporate rate can be lowered to 10% in the case of private corporations.

At provincial level, the following rates apply for investors interested in starting a business in Canada:

| Territory | Lowest Rate | Highest Rate |

| British Colombia | 2% | 12% |

| Manitoba | 0% | 12% |

| Northwest Territories | 4% | 11.5% |

| Nunavut | 4% | 12% |

| Ontario | 3.5% | 11.5% |

| Newfoundland and Labrador | 3% | 15% |

| Prince Edward Island | 4.5% | 16% |

| Nova Scotia | 3% | 16% |

| Saskatchewan | 2% | 12% |

| New Brunswick | 3% | 14% |

| Yukon | 2% | 12% |

Tax domicile of an LLC in Canada

As mentioned at the beginning of the article, the tax domicile can have a very important impact on the taxation of an LLC in Canada. Here are the general aspects to consider with respect to taxation of companies registered in Canada:

- the corporate tax imposed on a company depends on whether it is registered at a federal or provincial level;

- the taxation of an LLC can also be influenced by whether the shareholder/shareholders are residents or non-residents;

- the taxation of a company depends on whether the business qualifies for the Small Business Deduction;

- the Canadian private corporation is the most advantageous type of companies from a taxation point of view;

- there are several ways of reducing the corporate taxes paid by companies registered in Canada.

We offer tailored accounting services which can be of great help in reducing the taxes paid by an LLC in Canada. Our company registration agents can also help you incorporate a business as a non-resident in Canada.

The corporate tax rates applied on Canadian LLCs

The corporate tax in Canada is levied on different criteria, and the most important one is the tax domicile of the LLC. A company can be registered at a federal level, case in which it will pay the tax applied at this level or can be imposed at a provincial or territorial level. This implies for the LLC to be taxed in the Canadian province or territory it was registered in.

The standard corporate tax applied to LLCs incorporated at a federal level in Canada is 38%, however, with the tax abatement, the rate will decrease at 28%. With respect to provincial and territorial corporate tax rates, these apply at local levels and are subject to changes on a yearly basis. This is why it is recommended to verify the annual rates on the Canadian Revenue Agency’s website.

If you need assistance for opening a business in Canada at a federal or provincial level, you can rely on our consultants. We can also help you choose the type of company you can operate under.

The Small Business Deduction in Canada

One of the most important parts of the taxation of an LLC in Canada refers to the payment of the Small Business Deduction (SDB) which applies to private corporations registered at federal and provincial levels. In 2019, the rate of the Small Business Deduction was 19% at a federal level. Combined with the tax abatement granted by the Canadian Revenue Agency (CRA), the rate drops at 9%.

The SDB is calculated on the number of days a company undertakes activities in a calendar year. The maximum amount of money a Canadian LLC can deduct under this incentive is 500,000 CAD. Our accountants can help you apply for the SDB for your LLC in Canada.

Accounting requirements imposed on LLCs in Canada

In order to pay the corporate tax, an LLC in Canada is required to comply with the accounting and reporting requisites of the CRA.

An LLC must file the following accounting documents:

- the T2 corporate tax return which is filed on a yearly basis, and no later than 6 months after the end of the financial year;

- the financial statement of the company, which must be accompanied by the schedule of the returns;

- LLCs must also send Goods and Services or Harmonized Sales Tax returns, in accordance with their reporting calendars;

- other documents could be required by the provincial and territorial offices of the Canadian Revenue Agency.

It is important to know that an LLC must file its tax returns in the province or territory it was registered in. From there, the local authorities will withhold the tax as required under the local regulations and forward the amount of money due to the federal government.

Frequently asked questions

1. Can a non-resident person start a company in Canada?

Yes, foreign citizens or investors are welcome to open companies in Canada under the same conditions as locals.

2. Do I need a residence permit if I want to start a company in Canada?

In most cases, a residence permit is necessary for foreign citizens starting a business in Canada.

3. What are the steps for company incorporation in Canada?

The first step for opening a company in Canada is related to choosing a company name. Following that, the incorporation papers must be prepared and filed with the Trade Register. Then, special licenses or permits must be obtained. Our company formation agents in Canada can assist with the registration process of a business.

Please mind that, regardless of the economic activity that you will start here, you will need the services of accountants in Canada, as per the applicable law.

4. What types of companies can I open in Canada?

One can open several types of companies in Canada, however the most common one is the corporation. The Canadian corporation is the equivalent of the limited liability company.

5. Does the company have to be registered in Canada?

Yes, in order to be considered a resident company, a business must have a registered address in Canada. The company seat may be registered in one of the Canadian provinces.

6. How fast can I incorporate a company in Canada?

The company registration procedure is not lengthy in Canada. However, the investor must pay attention to all the steps and follow the exact steps prescribed by the Commercial Code. Our company registration consultants in Canada can explain these steps.

7. What is the minimum share capital in Canada?

The Commercial Law does not impose a minimum share capital for registration of a company. However, the company will need a capital.

8. What are the taxes that I have to pay in Canada?

The taxation system in Canada is imposed at federal and territorial levels. The rates also differ and are applied for different thresholds of income, which is why accounting services are recommended.

9. How can I open a Canadian bank account?

Foreign citizens have the right to open bank accounts in Canada, no matter if they are unemployed or employed. Also, companies must open corporate bank accounts where the share capital must be deposited. Our local advisors can offer information on the documents required to open a bank account.

10. Do I need special permits and licenses in Canada?

Yes, depending on the activities a company will undertake, special licenses will be required.

For further information about company incorporation in Canada, we invite you to contact our team of advisors.